Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Disclaimer***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision.

Open to apply: 06 Aug 2024

Close to apply: 12 Aug 2024

Balloting: 14 Aug 2024

Listing date: 22 Aug 2024

Share Capital

Market cap: RM580 mil

Total Shares: 2.00 bil shares

Industry CARG (2019-2023)

Wood pellet industry size in Asia Pacific: 6.9%

Palm kernel shell industry size in Asia Pacific: 6.7%

Industry competitors comparison (net profit%)

1. EEHB : 7.0%

2. Rainbow Pellet Sdn Bhd: 27.4%

3. Kyoto Oils & Grains (M) Sdn Bhd: 12.1%

4. Top Energy Sdn Bhd: 7.7%

5. Maya Wood Pellets Sdn Bhd: 3.7%

6. Others: losses to 2.5%

Business (FPE 2024)

manufacturing and trading of biomass fuel products, particularly PKS and wood pellets.

Principal Activities

Manufacturing of PKS: 83.28%

Manufacturing and trading of wood pellets: 16.72%

Revenue by countries

Malaysia: 6.82%

Singapore: 47.59%

Indonesia: 31.54%

Japan: 14.05%

Fundamental

1.Market: Ace Market

2.Price: RM0.29

3.Forecast P/E: 24.61

4.ROE(forecast Pro forma III): 30.65%

5.ROE: 89.8% (FPE2024), 67.26% (FYE2023), 54.84%(FYE2022), 33.64%(FYE2021)

6.Net asset: RM0.05

7.Total debt to current asset: 0.40 (Debt: 76.521mil, Non-Current Asset: 32.287mil, Current asset: 190.745mil)

8.Dividend policy: No formal dividend policy.

9. Shariah status: Yes

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2024 (FPE, 30Apr): RM117.657 mil (Eps: 0.0075), PAT: 12.72%

2023 (FPE 31Dec): RM335.251 mil (Eps: 0.0118), PAT: 7.03%

2022 (FYE 31Dec): RM144.440 mil (Eps: 0.0031), PAT: 4.35%

2021 (FYE 31Dec): RM115.114 mil (Eps: 0.0090),PAT: 1.51%

Major customer (FPE 2024)

1. PT. Apac Metal Indonesia: 31.54%

2. Z & Z SG Pte Ltd: 24.87%

3. Deus Ex Capital Pte Ltd.: 22.73%

4. JFE Shoji Corporation: 8.64%

5. Tokyo Sangyo Co., Ltd: 5.4%

***total 93.18%

Major Sharesholders

1. Yeo Hock Cheong: 5.01% (direct), 36.99% (indirect)

2. Kayavest: 16.37% (direct)

3. Mikro MSC: 20.62% (direct)

4. Bio Eneco Holding Sdn Bhd: 11.50% (direct)

5. Salihudin : 0.075% (direct)

Directors & Key Management Remuneration for FYE2024

(from Revenue & other income 2023)

Total director remuneration: RM1.356 mil

key management remuneration: RM0.40 mil – RM0.55 mil

total (max): RM1.906 mil or 4.12%

Use of funds

1. Construction of new factory and warehouse in Kuantan: 47mil, 46.31%

2. Purchase of new machineries and equipment: 21.141 mil, 20.82%

3. Working capital: 27.059 mil, 26.66%

4. Estimated listing expenses: 6.3mil, 6.21%

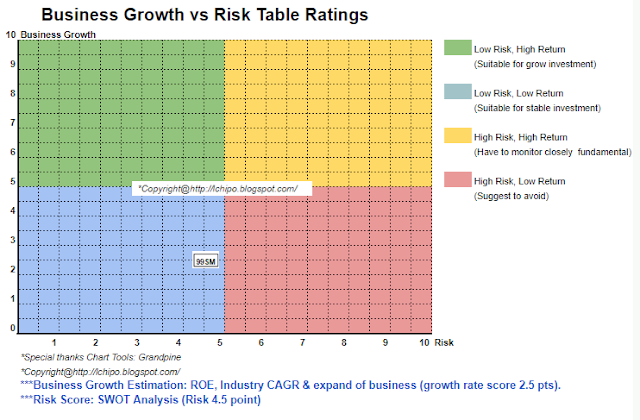

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is low to middle risk of investment, and have potential to fast in business revenue upon the 3 new factory to be completed by Q2, 2025.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.