Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Disclaimer***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision.

Open to apply: 28/02/2025

Close to apply: 06/03/2025

Balloting: 10/03/2025

Listing date: 21/03/2025

Balloting: 10/03/2025

Listing date: 21/03/2025

Share Capital

Market cap: RM737.757 mil

Total Shares: 838.360 mil shares

Market cap: RM737.757 mil

Total Shares: 838.360 mil shares

Industry CARG

1. Value of construction works completed by sub-sector in Malaysia (2019-2024f): 1.2447%

2. Building materials industry in Malaysia (2019-23): 0.7%

3. Lighting and M&E products industry in Malaysia (2019-23): 18.8%

4. Hardware, tools and machinery industry in Malaysia (2019-23): 8.9%

5. Overhang properties by location in Malaysia (2019-24Q3): -6.45% (2024Q3: 21,968 unit)

1. Value of construction works completed by sub-sector in Malaysia (2019-2024f): 1.2447%

2. Building materials industry in Malaysia (2019-23): 0.7%

3. Lighting and M&E products industry in Malaysia (2019-23): 18.8%

4. Hardware, tools and machinery industry in Malaysia (2019-23): 8.9%

5. Overhang properties by location in Malaysia (2019-24Q3): -6.45% (2024Q3: 21,968 unit)

Industry competitors comparison (net profit%)

1. LSH capital Group: 20.6%

2. AME Elite Consortium Berhad: 17.6%

3. Crescendo Corporation Berhad: 16.7%

4. YTL Corp: 12.7%

5. IJM Corporation Berhad: 11.2%

6. Naim Holdings Berhad: 11.1%

7. Others: 0.4% to 9.6%

1. LSH capital Group: 20.6%

2. AME Elite Consortium Berhad: 17.6%

3. Crescendo Corporation Berhad: 16.7%

4. YTL Corp: 12.7%

5. IJM Corporation Berhad: 11.2%

6. Naim Holdings Berhad: 11.1%

7. Others: 0.4% to 9.6%

Business (FYE 2024)

Construction and engineering works, provision of construction-related services and solutions, supply of building materials, lighting and related M&E products, hardware products and tools, rental of construction machinery and equipment as well as property development activities

Revenue by segments

1. Construction: 79.74%

2. Property development: 20.26%

Fundamental

1.Market: Ace Market

2.Price: RM0.88

3.Forecast P/E: 9.93

4.ROE(Pro forma): 12.97%

5.ROE: 15.63%(FYE2024), 13.99%(FYE2023), 52.59%(FYE2022), 18.29%(FYE2021)

6.Net asset: 0.68

7.Total debt to current asset: 0.30 (Debt: 166.564mil, Non-Current Asset: 189.913mil, Current asset: 549.336mil)

8.Dividend policy: 30% PAT dividend policy.

9. Shariah status: Yes

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2024 (FPE 30 Sep): RM361.405 mil (Eps: 0.0886), PAT: 14.44%

2023 (FYE 30 Sep): RM357.755 mil (Eps: 0.0700), PAT: 16.46%

2022 (FYE 30 Sep): RM165.866 mil (Eps: 0.0499),PAT: 25.21%

2021 (FYE 30 Sep): RM67.416 mil (Eps: 0.0095),PAT: 11.76%

***we didn’t follow prospectus book pg 265 EPS as EPS calculation didn’t use enlarged shares volume.

1.Market: Ace Market

2.Price: RM0.88

3.Forecast P/E: 9.93

4.ROE(Pro forma): 12.97%

5.ROE: 15.63%(FYE2024), 13.99%(FYE2023), 52.59%(FYE2022), 18.29%(FYE2021)

6.Net asset: 0.68

7.Total debt to current asset: 0.30 (Debt: 166.564mil, Non-Current Asset: 189.913mil, Current asset: 549.336mil)

8.Dividend policy: 30% PAT dividend policy.

9. Shariah status: Yes

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2024 (FPE 30 Sep): RM361.405 mil (Eps: 0.0886), PAT: 14.44%

2023 (FYE 30 Sep): RM357.755 mil (Eps: 0.0700), PAT: 16.46%

2022 (FYE 30 Sep): RM165.866 mil (Eps: 0.0499),PAT: 25.21%

2021 (FYE 30 Sep): RM67.416 mil (Eps: 0.0095),PAT: 11.76%

***we didn’t follow prospectus book pg 265 EPS as EPS calculation didn’t use enlarged shares volume.

Order Book (as per 31/01/2025)

1. LPD: RM 614.555 mil

Major customer (2024)

1. Besteel Engtech Sdn Bhd: 41.58%

2. SLP Construction Sdn Bhd:11.07%

3. Pertama Makmur Sdn Bhd: 5.10%

4. Euro Saga Sdn Bhd: 4.61%

5. Tekad Warisan (M) Sdn Bhd: 4.44%

***total 66.80%

Major Sharesholders

1. LSH Resources: 64.65% (direct)

2. LSH Holdings: 64.65% (indirect)

3. Tan Sri Datuk Seri Lim Keng Cheng, Aged 62: 1.78% (direct), 64.65% (indirect)

4. Datuk Lim Keng Guan, Aged 60: 1.78% (direct), 64.65% (indirect)

5. Lim Pak Lian, Aged 59 : 1.78% (direct), 64.67% (indirect)

6. Lim Keng Hun, Aged 57: 1.78% (direct), 64.65% (indirect)

Directors & Key Management Remuneration for FYE2025

(from Revenue & other income 2024)

Total director remuneration: RM4.104 mil

key management remuneration: RM1.125 mil – RM1.375 mil

total (max): RM5.479 mil or 4.27%

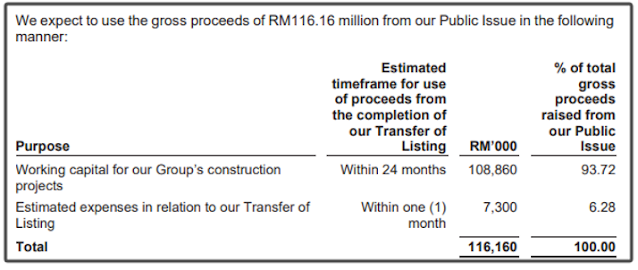

Use of funds

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is mid risk investment, and also come with low-mid grow return opportunities.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.