Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Disclaimer***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision.

Share Capital

Market cap: RM69.3 mil

Total Shares: 495 mil shares

1st day listing tradable shares: 146.619 mil

Industry CARG

1. Wholesale value of black tiger prawns* , Malaysia, 2019 – 2024: 11.31%

2. Production volume of black tiger prawns, Malaysia, 2019 – 2024e: 8.19%

3. Export value of black tiger prawns, Malaysia, 2019 – 2023: -10.43%

Industry competitors comparison (net profit%)

1.Camaroe Group: 20.27%

2.MAG Holdings Berhad: 10.72%

3.QL Marine Products Sdn Bhd: 9.67%

4.SBH Marine Holdings Berhad: 1.75%

5.Others: losses to 4.99%

Business (FPE 2025)

Prawn aquaculture: principal activities comprise farming and processing of prawns, primarily black tiger prawns.

Revenue by segment

1. Frozen black tiger prawns: 75.89%

2. Live prawns: 24.11%

Revenue by Geo

1. Malaysia: 29.71%

2. China: 61.82%

3. South Korea: 8.47%

Fundamental

1.Market: Ace Market

2.Price: RM0.14

3.Forecast P/E: 8.59

4.ROE(Pro forma): 21.26%

5.ROE: 29.49%(FYE2024), 52.46%(FYE2023), 50.94%(FYE2022), 73.04%(FYE2021)

6.Net asset per shares: 0.08

7.Total debt to current asset: 0.58 (Debt: 20.653mil, Non-Current Asset: 23.133mil, Current asset: 35.493mil)

8.Dividend policy: Didn’t have formal dividend policy.

9. Shariah status: -

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2025 (FPE 31Mar, 3 mths): RM8.224 mil (Eps: 0.0013), PAT: 20.34%

2024 (FYE 31Dec): RM39.823 mil (Eps: 0.0163), PAT: 19.45%

2023 (FYE 31Dec): RM33.909 mil (Eps: 0.0236), PAT: 23.09%

2022 (FYE 31Dec): RM36.010 mil (Eps: 0.0171),PAT: 23.30%

2021 (FYE 31Dec): RM38.179 mil (Eps: 0.0158),PAT: 16.42%

Major customer (FPE 2025)

1. Shanghai Pinzhuan International Trade Co., Ltd: 49.21%

2. Pantai Seafood Supply: 14.43%

3. Customer A: 8.48%

4. Shanghai XiJuan Supply Chain Technology Co Ltd : 7.83%

5. Dragon Ocean Fishery: 6.92%

***total 86.87%

Major Sharesholders

1. Teoh Han Boon, Aged 53: 35.39 (direct), 28.91% (indirect)

2. Low Saw Cheng, Aged 53: 28.76% (direct), 35.54% (indirect)

3. Teoh Kheng Huat, Aged 50: 6.08% (direct)

Directors & Key Management Remuneration for FYE2025

(from Revenue & other income 2024)

Total director remuneration: RM1.872 mil

key management remuneration: RM300 mil – RM450 mil

total (max): RM2.322 mil or 17.83%

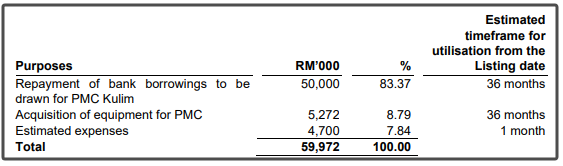

Use of funds

Overall is high risk investment, and also come with low grow return opportunities.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.