Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision

Close to apply: 18/03/2022

Balloting: 23/03/2022

Listing date: 01/04/2022

Share Capital

Market Cap: RM200.4 mil

Total Shares: 668 mil shares

Industry & Competitor

Pawbroking industry in Malaysia CARG: 4.79%

Ar-Rahnu CARG: -9.77%

Industry market shares: 2.15% (2020, included Ar-Rahnu).

Business (2021)

Pawnbroking in Malaysia (Pajak Gadai) with interest rate 1.3%-2% pawn loan (per month).

Pawnbroking: 56.37%

Sale of unredeemed or bid pledges: 43.63%

Fundamental

1.Market: Ace Market

2.Price: RM0.30

3.P/E: 24.39

4.ROE(Pro Forma III): 4.02% (FPE2021)

5.ROE: 7.54%(FYE2020), 3.03%(FYE2019), 2.86%(FYE2018)

6.NA after IPO: RM0.24

7.Total debt to current asset after IPO: 0.11 (Debt: 18.883mil, Non-Current Asset: 10.487mil, Current asset: 169.337mil)

8.Dividend policy: no formal dividend policy.

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2021 (FPE 30Sep): RM25.407 mil (Eps: 0.0081),PAT:21.36%

2020 (FYE 31Dec): RM30.769 mil (Eps: 0.0123),PAT:26.67%

2019 (FYE 31Dec): RM19.207 mil (Eps: 0.0029),PAT:10.22%

2018 (FYE 31Dec): RM10.010 mil (Eps: 0.0024),PAT:15.69%

After IPO Sharesholding

1. TSE Sejahtera: 47.85%

2. Lim Boon Hua: 50.17% (indirect)

3. Law Book Ching: 47.85% (indirect)

4. Lim Siew Fang: 47.85% (indirect)

5. Lee Kooi Lan: 47.85% (indirect)

Directors & Key Management Remuneration for FYE2022 (from gross profit 2021)

Total director remuneration: RM0.441mil

key management remuneration: RM0.305mil

total (max): RM0.746mil or 5.4%

Use of fund

1.Expansion of pawnbroking outlets: 38.36%

2. Cash capital for existing 20 pawnbroking outlets: 54.05%

3. Listing expenses: 7.59%

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

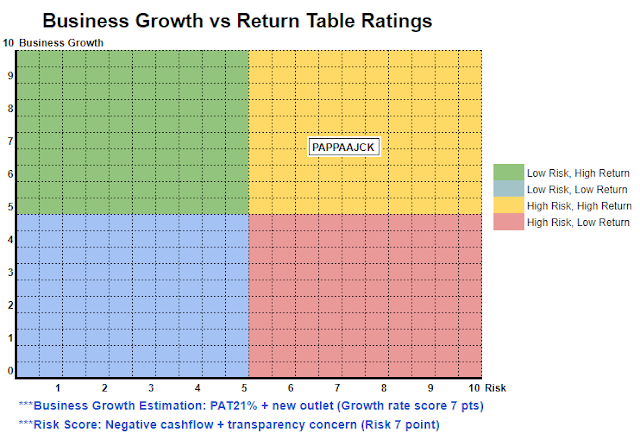

Is a attractive IPO on the high interest return business but also come with high risk (category as high risk high return investment).

Is a attractive IPO on the high interest return business but also come with high risk (category as high risk high return investment).

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.