Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

opinion and reader should take their own risk in investment decision.

Close to apply: 18 Jan 2024

Balloting: 22 Jan 2024

Listing date: 29 Jan 2024

Share Capital

Market cap: RM397.8 mil

Total Shares: 1.020 bil shares

Major Infrastructure Projects Undertaken, or in the Pipeline, in Malaysia: RM181.6 bil

Industry competitors comparison (PAT%)

MTG Group: 5.4%

SCGBHD: 1.7% (PE15.94)

Central Cables Berhad: 5.9%

Hi-Essence Cable Sdn Bhd: 4.3%

Olympic Cable Company Sdn Bhd: 2.9%

Power Cables Malaysia Sdn Bhd: 4.3%

Sindutch Cable Manufacturer Sdn Bhd: Losses

Tai Sin Electric Cables (Malaysia) Sdn Bhd: 2.8%

Tonn Cable Sdn Bhd: 1.6%

Business (FYE 2022)

Manufacturing and distribution of power cables, control and instrumentation cables, and other related products, and the trading of power cables, fibre optic cables, and other related products.

Revenue by Geo

Malaysia: 94.85%

Others Asean country: 5.15%

Fundamental

1.Market: Ace Market

2.Price: RM0.39

3.Forecast P/E: 16.96 @ (forecast FPE2023, EPS RM0.023)

4.ROE(Pro Forma III): 17.22%

5.ROE: 22.68%(FYE2022), 7.24%(FYE2021), 7.17%(FYE2020)

6.Net asset: 0.1552

7.Total debt to current asset: 0.61 (Debt: 112.950mil, Non-Current Asset: 86.231mil, Current asset: 185.01mil)

8.Dividend policy: 30% PAT dividend policy.

9. Shariah status: Yes

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2023 (FPE 30 Jun, 6mths): RM138.039 (Eps: 0.0134),PAT: 9.88%

2022 (FYE 31 Dec): RM362.685 mil (Eps: 0.0192),PAT: 5.39%

2021 (FYE 31 Dec): RM275.875 mil (Eps: 0.0054),PAT: 2.01%

2020 (FYE 31 Dec): RM162.313 mil (Eps: 0.0052),PAT: 3.24%

*Prospectuses book pg224 using EPS diluted 861.9 mil shares, here rejected use this version, writer use 1.020 bil shares as diluted EPS.

Major customer (FPE 2023)

1. TNB Group: 35.97%

2. Pen Power Sdn Bhd: 11.74%

3. SEB Group: 7.45%

4. Oon Brothers Eectrical Trading Co Sdn Bhd: 3.19%

5. Incomtec Consolidated Sdn Bhd: 2.40%

***total 60.75%

Major Sharesholders

1. Dato’ Lau Kim San: 55% (indirect)

2. MTPC: 55% (direct)

(from Revenue & other income 2022)

Total director remuneration: RM2.935mil

key management remuneration: RM0.4mil – RM0.6mil

total (max): RM3.535 mil or 10.06%

Use of funds

1. Construction of new MV power cable manufacturing plants: 27.22%

2. Purchase of new machineries and equipment: 39.55%

3. General working capital: 26.42%

4. Defray fees and expenses relating to the Proposals: 6.81%

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

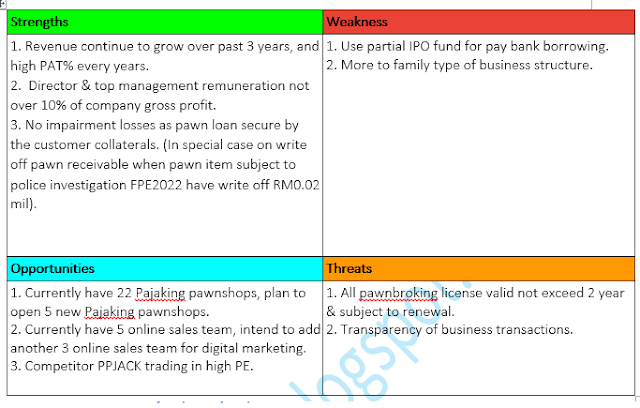

Overall is a low PAT% business.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.