Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal

opinion and reader should take their own risk in investment decision.

opinion and reader should take their own risk in investment decision.

Open to apply: 12 JAN 2024

Close to apply: 18 JAN 2024

Balloting: 22 JAN 2024

Listing date: 30 JAN 2024

Close to apply: 18 JAN 2024

Balloting: 22 JAN 2024

Listing date: 30 JAN 2024

Share Capital

Market cap: RM123.2 mil

Total Shares: 440 mil shares

Market cap: RM123.2 mil

Total Shares: 440 mil shares

Industry CARG

Value of Construction Work Completed for Non-Residential Buildings: -2.5%

Value of Construction Work Completed for Electrical Installation: 14.2%

Number of Applications for New Electrical Installations: 4.3%

Number of Applications for Existing Electrical Installations: 3.8%

Competitors comparison (PAT%)

1. HE Group: 5.7% (PE12.9)

2. LWE Engineering S/B: 10.6%

3. Hong Hin Electrical S/B:

4. CBH Engineering S/B: 8.8%

5. PESTECH S/B: 4.1%

6. Kinergy Advancement Bhd: 1.5% (PE30.18)

7. Others: -0.4% to 7.2%

Business (FPE 2023)

Provision of power distribution system, other building systems and works, hook-up and retrofitting of electrical equipment and trading.

Revenue Segment

1. Power distribution: 66.54%

2. Other building system and works: 28.49%

3. Electrical equipment hook-up and retrofitting: 4.81%

4. Trading of electrical product: 0.16%

Provision of power distribution system, other building systems and works, hook-up and retrofitting of electrical equipment and trading.

Revenue Segment

1. Power distribution: 66.54%

2. Other building system and works: 28.49%

3. Electrical equipment hook-up and retrofitting: 4.81%

4. Trading of electrical product: 0.16%

Fundamental

1.Market: Ace Market

2.Price: RM0.28

3.Forecast P/E: 12.90 (estimated latest 12 month, EPS RM0.0217)

4.ROE(Proforma III): 16.61%

5.ROE: 38.8%(FPE2022), 32.5%(FYE2021), 18.69%(FYE2020).

6.Net asset: RM0.10

7.Total debt to current asset: 0.732 (Debt: 87.464 mil, Non-Current Asset: 6.867mil, Current asset: 119.471mil)

8.Dividend policy: didn't have formal dividend policy.

9. Shariah status: Yes

1.Market: Ace Market

2.Price: RM0.28

3.Forecast P/E: 12.90 (estimated latest 12 month, EPS RM0.0217)

4.ROE(Proforma III): 16.61%

5.ROE: 38.8%(FPE2022), 32.5%(FYE2021), 18.69%(FYE2020).

6.Net asset: RM0.10

7.Total debt to current asset: 0.732 (Debt: 87.464 mil, Non-Current Asset: 6.867mil, Current asset: 119.471mil)

8.Dividend policy: didn't have formal dividend policy.

9. Shariah status: Yes

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2023 (FPE 31Aug, 8mth): RM138.577 mil (Eps: 0.0165), PAT: 5.24%

2022 (FYE 31Dec): RM107.573 mil (Eps: 0.0140), PAT: 5.73%

2021 (FYE 31Dec): RM100.461 mil (Eps: 0.0094), PAT: 4.12%

2020 (FYE 31Dec): RM31.388 mil (Eps: 0.0039), PAT: 5.41%

Order Book

FYE2023: 22.993mil

FYE2024: 188.916mil

Trade receivable vs revenue

2020: 33.3%

2021: 37.73%

2022: 39.6%

2023: 45.76%

Major customer (2023)

1. Customer A: 42.11%

2. Zalam Corporation Sdn Bhd: 31.95%

3. Customer C: 9.25%

4. Exyte Malaysia Sdn Bhd: 6.45%

5. Xeonics Co., Ltd: 4.59%

***total 94.35%

Major Sharesholders

1. Haw Chee Seng: 20.42% (direct)

2. Eng Choon Leong: 14.8% (direct)

3. Hexatech Energy Consolidated Sdn Bhd: 24.6% (direct)

4. Yong Chong Cheang: 24.6% (indirect)

Directors & Key Management Remuneration for FYE2023

(from Revenue & other income 2022)

Total director remuneration: RM0.884 mil

key management remuneration: RM0.85mil – RM1.1mil

total (max): RM1.984 mil or 13.22 %

Use of funds

1. Business expansion: 15%

2. Capital expenditure: 7.19%

3. Working capital: 62.19%

4.Estimated listing expenses: 15.62%

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

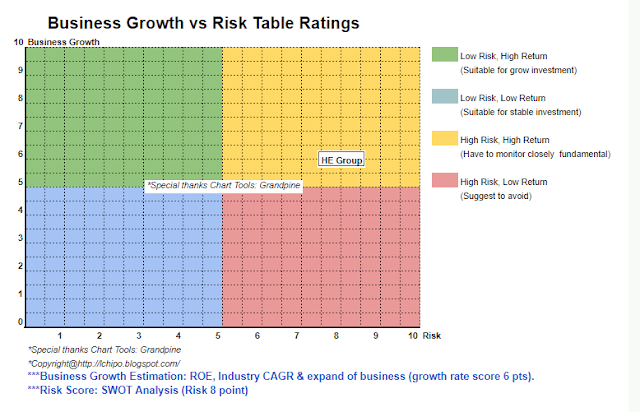

Overall is reasonable price and but risk level is a bit high.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.