Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/***Important***Blogger is not wrote any recommendation & suggestion. All is personal

opinion and reader should take their own risk in investment decision.

opinion and reader should take their own risk in investment decision.

Open to apply: 21 May 2024

Close to apply: 04 Jun 2024

Balloting: 07 Jun 2024

Listing date: 19 Jun 2024

Share Capital

Market cap: RM240 mil

Total Shares: 800 mil shares

First day tradable shares: 205mil shares

Industry CARG

Value of property transactions in Sabah, 2018 – 2023: 5.59%

Volume of property transactions in Sabah, 2018 – 2023: 3.18%

Overhang residential properties 2018 – 2023: 8.47%

Overhang shops 2018 – 2023: 8.21%

Industry competitors comparison (PBT%)

1. KTI Landmark: 14.40%

2. Hapseng: 18.71% (PE14.09)

3. SBCcorp: 1.57% (nett PE, losses))

4. WMG: losses

5. IJM land Berhad: 10.65% (PE28.58)

6. Hohup Group: losses

7. Asiapac: 6.31% (PE42.39)

8. Others: 6.59% to 21.19%

Business (FYE 2023)

Property developer, principally involved in the provision of design and build construction services and property development.

Fundamental

1.Market: Ace Market

2.Price: RM0.30

3.Forecast P/E: 17.65 (FYE2023, EPS RM0.017)

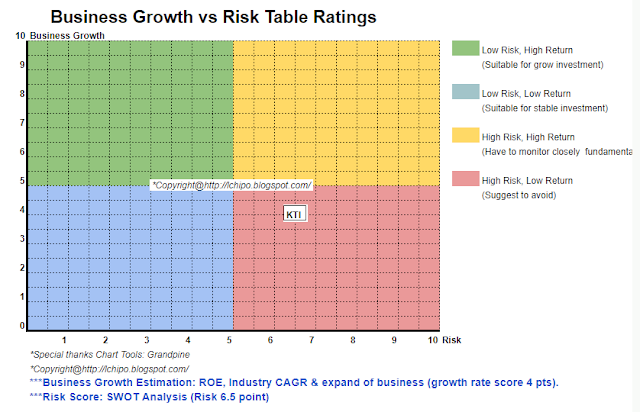

4.ROE(Pro Forma III): 8.34%

5.ROE: 10.12%(FYE2023), 7.6%(FYE2022), 12.27%(FYE2021), 11.28%(FYE2020)

6.Net asset: 0.20

7.Total debt to current asset: 0.697 (Debt: 218.920mil, Non-Current Asset: 70.527mil, Current asset: 314.200mil)

8.Dividend policy: no formal dividend policy.

9. Shariah status: -

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2023 (FYE 31Dec): RM120.167 mil (Eps: 0.017), PAT: 11.5%

2022 (FYE 31Dec): RM112.880 mil (Eps: 0.013), PAT: 9.3%

2021 (FYE 31Dec): RM98.518 mil (Eps: 0.020), PAT: 15.9%

2020 (FYE 31Dec): RM90.193 mil (Eps: 0.016), PAT: 14.0%

Major customer (2023)

Nature of business didn’t have single large major customer.

Major Sharesholders

1. Chin Mee Leen : 60.7% (direct)

2. Loke Theen Fatt: 13.7%% (direct)

Directors & Key Management Remuneration for FYE2024

(from Revenue & other income 2023)

(from Revenue & other income 2023)

Total director remuneration: RM2.883 mil

key management remuneration: RM1.05 mil – RM1.20 mil

total (max): RM4.083 mil or 11.47%

Use of funds

1. Acquisition of land for development: 37.5%

2. Upgrading existing / expansion of our casting yard / IBS facility for our building division: 4.5%

3. Upgrading software and systems: 0.7%

4. Working capital for project development: 43.1%

5. Repayment of bank borrowings: 6.3%

6. Estimated listing expenses: 7.9%

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall that is possible is an overvalued IPO.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.