Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Disclaimer***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision.

Open to apply: 15 Aug 2024

Close to apply: 23 Aug 2024

Price Determination Date: 27 Aug 2024

Balloting: 29 Aug 2024

Listing date: 09 Sep 2024

Close to apply: 23 Aug 2024

Price Determination Date: 27 Aug 2024

Balloting: 29 Aug 2024

Listing date: 09 Sep 2024

Share Capital (might differ depend on final determination price)

Market cap: RM13.860 bil

Total Shares: 8.40 bil shares

1st day listing tradable shares: 1.428 bil shares

Industry CARG

Grocery-based Retail Industry in Malaysia, 2022–2028F (sales value)

Hypermarket: 5.3%

Supermarket: 6.4%

Mini-market: 5.4%

Convenience stores: 10.9%

Other grocery –based retailers: 4.0%

Industry competitors comparison (profit before tax margin %)

1. 99 Speedmart: 5.8%

2. 7-Eleven : 0.8%

3. KK supermart: 10.4%

4. Mynews: -1.0%

5. Others: -2.2% to 6.0%

1. 99 Speedmart: 5.8%

2. 7-Eleven : 0.8%

3. KK supermart: 10.4%

4. Mynews: -1.0%

5. Others: -2.2% to 6.0%

Business (FPE 2024)

“99 Speedmart” chain of mini-market outlets involved in the retailing of daily necessities, with 2,542 outlets located nationwide.

Subsidiaries

1. 99SM : Retail of consumable merchandise and other household products via its network of “mini-market” outlets

2. 99EM: Retail of consumable merchandise and other household products via its network of “mini-market” outlets

3. Yiwu J-Jade Trading: Investment holding

4. Yiwu SM Import and Export: Exporting of consumable merchandise and household products

Fundamental

1.Market: Main Market

2.Price: RM1.65 (final price will determine at 27/08/2024)

3.Forecast P/E: 34.7

4.ROE(Pro Forma III): 43.81%

5.ROE: 78.93% (FPE2024), 73.9% (FYE2023) , 51.70%(FYE2022), 56.87%(FYE2021)

6.Net asset (Pro forma III): 0.14

7.Total debt to current asset: 1.048 (Debt: 2.036bil, Non-Current Asset: 1.309 bil, Current asset: 1.943 bil)

8.Dividend policy: 50% PAT dividend policy.

9. Shariah status: -

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2023 (FPE 31 Mar, 3mth): RM2.424 bil (Eps: 0.016), PAT: 5.5%

2023 (FYE 31Dec): RM9,240 bil (Eps: 0.048), PAT: 4.3%

2022 (FYE 31Dec): RM8.075 bil (Eps: 0.039), PAT: 4.0%

2021 (FYE 31Dec): RM7.836 bil (Eps: 0.050),PAT: 5.3%

Major customer

Business model retail consumer. There is no single major customer.

Major Sharesholders

1. Lee LYG Holdings: 51.5% (direct)

2. Lee Thiam Wah: 25.7% (direct), 51.5% (indirect)

Directors & Key Management Remuneration for FYE2024

(from Revenue & other income 2023)

Total director remuneration: RM3.335 mil

key management remuneration: RM2.20 mil – RM2.60 mil

total (max): RM5.935 mil or 0.70%

Use of funds

1. Expansion of network of outlets: 389 mil, 58.9%

2. Establishment of new DCs: 100 mil, 15.2%

3. Purchase of delivery trucks: 55 mil, 8.3%

4. Upgrading of existing outlets: 47.6 mil, 7.2%

5. Repayment of existing bank borrowings: 45 mil, 6.8%

6. Estimated listing expenses: 23.4 mil, 3.6%

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

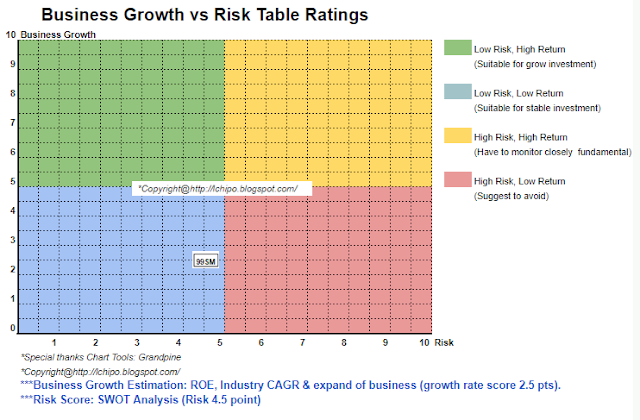

Overall is more to low risk business, but also come with low grow opportunities.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.

Overall is more to low risk business, but also come with low grow opportunities.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.