Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision

Share Capital

Market Cap: RM146.890 mil

Total Shares: 489.634 mil shares

Industry Competitor (revenue)

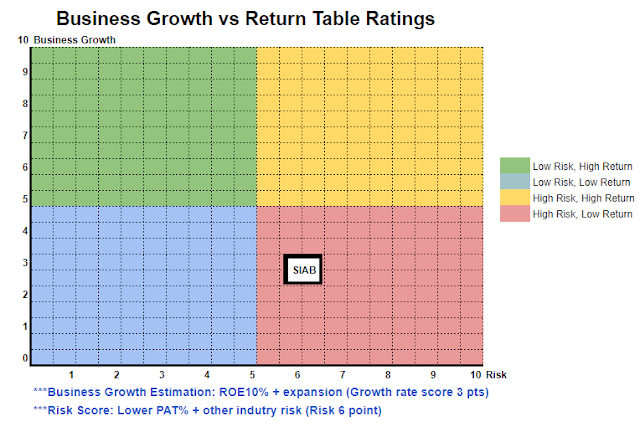

Siab: PAT4%, PE13.33, ROE11.97

Inta Bina: PAT2.9%, PE13.52, ROE7.38

Nestcon: PAT4.2, PE42.21, ROE6.16

Pesona Metro: PAT-2.1%, PE37.16, ROE2.66

TCS: PAT6.7%, PE11.68, ROE13.57

Business (2021)

Building construction services

- Residential: 43.51%

- Non-Residential: 56.37%

ICT soloutions and services.

- others: 0.12%

Fundamental

1.Market: Ace Market

2.Price: RM0.30

3.P/E: 13.33 (EPS:0.0225)

4.ROE(Pro Forma III): 11.97% (forecast using 7mth FPE2021)

5.ROE: 30.07%(FYE2020), 24.22%(FYE2019), 24.19%(FYE2018)

6.NA after IPO: RM0.15

7.Total debt to current asset after IPO: 0.64 (Debt: 102.555mil, Non-Current Asset: 12.654mil, Current asset: 161.259mil)

8.Dividend policy: no formal dividend policy.

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2021 (7mths): RM104.498 mil (Eps: 0.0102),PAT:4.77%

2020: RM273.388 mil (Eps: 0.0225),PAT:4.04%

2019: RM242.888 mil (Eps: 0.0142),PAT:2.86%

2018: RM145.419 mil (Eps: 0.0083),PAT:3.62%

After IPO Sharesholding

Tan Sri Dato' Sri Mohamad Fuzi bin Harun: 0.06%

Ng Wai Hoe: 18.5%

Lim Mei Hwee: 12.75%

Tan Sok Moi: 9.5%

Datuk Lim Tong Lee: 0.06%

Dato' Sri Shahril bin Mokhtar: 0.06%

Andrea Huong Jia Mei: 0.06%

Directors & Key Management Remuneration for FYE2022 (from gross profit 2020)

Total director remuneration: RM2.211mil

key management remuneration: RM0.50 mil - 0.65mil

total (max): RM2.861 mil or 26.3%

Use of fund

Purchase of land & construction of storage facility: 16.61%

Purchase of machinery & equipment: 35.74%

Purchase of BIM system software: 8.35%

Upgrade software & system: 2.21%

Office expansion: 0.82%

Working capital: 25.32%

Listing expenses: 10.95%

Highlight

-no

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is a normal IPO. The industry of the business it self is not attractive, because the low net profit margin environment.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.