Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Open to apply: 22/06/2021

Close to apply: 29/06/2021

Balloting: 02/07/2021

Listing date: 13/07/2021

Close to apply: 29/06/2021

Balloting: 02/07/2021

Listing date: 13/07/2021

Share Capital

Market Cap: RM100.373 mil

Total Shares: 223.0515 mil shares

Industry (Net Profit %)

Employee engagement platforms market, 2017-2020: CAGR 14.69%

Market Cap: RM100.373 mil

Total Shares: 223.0515 mil shares

Industry (Net Profit %)

Employee engagement platforms market, 2017-2020: CAGR 14.69%

Competitors compare (Profit before tax margin%)

Accenture PLC: PE33.8

Capgemini SE: PE28

HCL Technologies Limited: PE21.13

Infosys Limited: PE33

International Business Machines Corporation: PE24

Tech Mahindra Limited: PE21

Wipro Limited:PE28

Accenture PLC: PE33.8

Capgemini SE: PE28

HCL Technologies Limited: PE21.13

Infosys Limited: PE33

International Business Machines Corporation: PE24

Tech Mahindra Limited: PE21

Wipro Limited:PE28

Business

1. HCM: Human Capital Management (Consulting and implementation, Sale of software licences, Technical support and maintenance services).

2. IT staff augmentation services

3. HCM technology applications

Malaysia: 45.53%

Singapore: 11.37%

Thailand: 29.82%

Indonesia: 13.07%

Others: 0.21%

1. HCM: Human Capital Management (Consulting and implementation, Sale of software licences, Technical support and maintenance services).

2. IT staff augmentation services

3. HCM technology applications

Malaysia: 45.53%

Singapore: 11.37%

Thailand: 29.82%

Indonesia: 13.07%

Others: 0.21%

Fundamental

1.Market: Ace Market

2.Price: RM0.45 (EPS:RM0.034)

3.P/E: PE13.24

4.ROE(Pro Forma III): 32.22%

5.ROE: 103%(2020), -%(2019), 16.16%(2018), 2.95%(2017)

6.Cash & fixed deposit after IPO: 0.0509

7.NA after IPO: RM0.10

8.Total debt to current asset after IPO: 0.288 (Debt:6.922mil, Non-Current Asset: 4.594mil, Current asset: 24.049mil)

9.Dividend policy: No fixed dividend policy.

1.Market: Ace Market

2.Price: RM0.45 (EPS:RM0.034)

3.P/E: PE13.24

4.ROE(Pro Forma III): 32.22%

5.ROE: 103%(2020), -%(2019), 16.16%(2018), 2.95%(2017)

6.Cash & fixed deposit after IPO: 0.0509

7.NA after IPO: RM0.10

8.Total debt to current asset after IPO: 0.288 (Debt:6.922mil, Non-Current Asset: 4.594mil, Current asset: 24.049mil)

9.Dividend policy: No fixed dividend policy.

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2020: RM25.331 mil (Eps: 0.0340),PAT%: 29.74%

2019: RM15.439 mil (Eps: 0.0200),PAT%: 29.11%

2018: RM12.549 mil (Eps: 0.0007),PAT%: 1.41%

2017: RM6.808 mil (Eps: 0.0004),PAT%: 1.29%

*EPS 2020 & 2019 prospecture book pg234 might not correct.

2020: RM25.331 mil (Eps: 0.0340),PAT%: 29.74%

2019: RM15.439 mil (Eps: 0.0200),PAT%: 29.11%

2018: RM12.549 mil (Eps: 0.0007),PAT%: 1.41%

2017: RM6.808 mil (Eps: 0.0004),PAT%: 1.29%

*EPS 2020 & 2019 prospecture book pg234 might not correct.

After IPO Sharesholding (Director)

Dato’ CM Vignaesvaran A/L Jeyandran: 0.11%

Tan Chee Seng: 33.26%

Lee Miew Lan: 17.84%

Liew Yu Hoe: 1.63%

Goh Keng Tat: 0.11%

Sim Seng Loong @ Tai Seng: 0.11%

Dato’ CM Vignaesvaran A/L Jeyandran: 0.11%

Tan Chee Seng: 33.26%

Lee Miew Lan: 17.84%

Liew Yu Hoe: 1.63%

Goh Keng Tat: 0.11%

Sim Seng Loong @ Tai Seng: 0.11%

Directors & Key Management Remuneration for FYE2021 (from gross profit 2020)

Total director remuneration: RM2.125 mil

key management remuneration: RM0.3 mil- 0.35mil

total (max): RM2.475 mil or 16.13%

Total director remuneration: RM2.125 mil

key management remuneration: RM0.3 mil- 0.35mil

total (max): RM2.475 mil or 16.13%

Use of fund

Business expansion into Philippines: 9.98%

Expansion of Feet’s and Lark in Southeast Asia: 25.30%

R&D Research: 16.34%

Working capital: 30.13%

Listing expenses: 18.25%

Business expansion into Philippines: 9.98%

Expansion of Feet’s and Lark in Southeast Asia: 25.30%

R&D Research: 16.34%

Working capital: 30.13%

Listing expenses: 18.25%

Highlight

1. Expansion business into Philippines.

2. Expansion of Feet’s and Lark in Southeast Asia

3. Have successful experience in Msia, S'pore, Thailand & Indonesia.

1. Expansion business into Philippines.

2. Expansion of Feet’s and Lark in Southeast Asia

3. Have successful experience in Msia, S'pore, Thailand & Indonesia.

Good thing is:

1. PE13.24 is accepetable.

2. Revenue from multiple country.

3. IPO fund 81.75% use for business expansion.

4. Revenue is increase over the 4 years.

1. PE13.24 is accepetable.

2. Revenue from multiple country.

3. IPO fund 81.75% use for business expansion.

4. Revenue is increase over the 4 years.

The bad things:

1. ROE is not stable (ROE unable to use for estimationd).

2. Trade receivable sudently increase to RM11.805mil in 2020 (not overdue yet).

3. 18.25% IPO fund use for listing expenses is over average lisiting expenses percentage.

4. Directors & top management remuneration is over 16% from the gross profit.

1. ROE is not stable (ROE unable to use for estimationd).

2. Trade receivable sudently increase to RM11.805mil in 2020 (not overdue yet).

3. 18.25% IPO fund use for listing expenses is over average lisiting expenses percentage.

4. Directors & top management remuneration is over 16% from the gross profit.

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

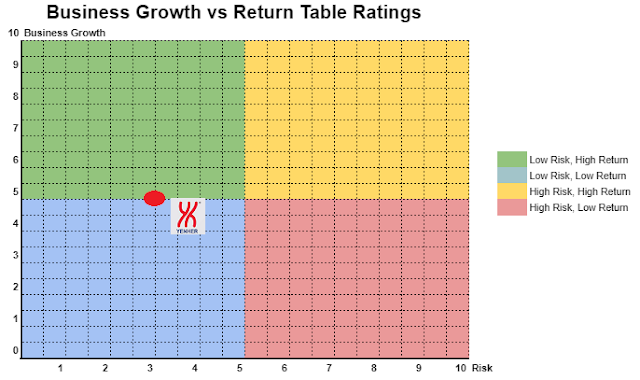

This is a IPO company that seek for expansion. Reader have to aware on the unable of the ROE, & have to hold it for aim for growth. It consider high risk and also come with high return potential category come company. This is not a dividend / passive income generated company for investor at this moment. For more on risk vs business expand ratio can refer to below chart.

This is a IPO company that seek for expansion. Reader have to aware on the unable of the ROE, & have to hold it for aim for growth. It consider high risk and also come with high return potential category come company. This is not a dividend / passive income generated company for investor at this moment. For more on risk vs business expand ratio can refer to below chart.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.