Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Disclaimer***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision.

Close to apply: 02/01/2025

Balloting: 06/01/2025

Listing date: 16/01/2025

Share Capital

Market cap: RM526.65 mil

Total Shares: 1.881 bil shares

Industry CARG

M&E engineering industry in Malaysia: 17%

Residential, commercial and industrial property transactions in Malaysia: 7.58%

Industry competitors comparison (net profit%)

1. CBH Engineering Holding Berhad: 15.9%

2. Kinergy Advancement Berhad: 13.8%

3. LFE Corporation Berhad: 13.3%

4. Savelite Engineering Sdn Bhd: 10.7%

5. MN Holdings Berhad: 9.5%

6. Others: losses to 10.9%

Electrical engineering service provider and specialise in electricity supply distribution systems.

CBH design, supply, installation, testing, commissioning and maintenance of HV, MV, LV and ELV electrical systems

Revenue by Segment

1. M&E systems

- Engaged as main contractor: 79.22%

- Engaged as subcontractor: 20.56%

2. M&E maintenance: 0.22%

Revenue by facility type

1. Substation: 86.81%

2. Industrial: 10.68%

3. Commercial: 2.23%

4. Residential: 0.28%

1.Market: Ace Market

2.Price: RM0.28

3.Forecast P/E: 15.91

4.ROE(Pro forma III): 27%

5.ROE: 42.14%(FYE2023), 30.89%(FYE2022), 7.65%(FYE2021)

6.Net asset: 0.09

7.Total debt to current asset: 0.204 (Debt: 42.196mil, Non-Current Asset: 5.546mil, Current asset: 206.861mil)

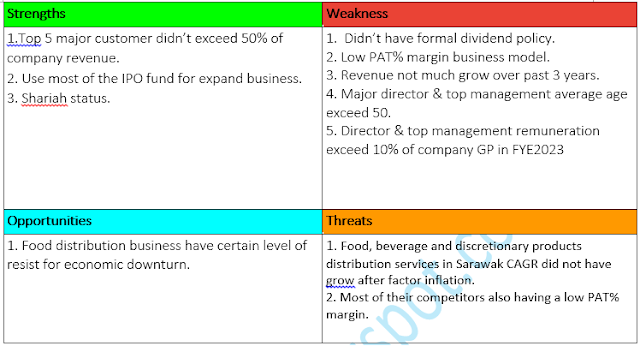

8.Dividend policy: didn’t have formal dividend policy.

9. Shariah status: Yes

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2024 (FPE 31Aug, 8mths): RM178.225 mil (Eps: 0.0163), PAT: 17.2%

2023 (FYE 31Dec): RM207.954 mil (Eps: 0.0176), PAT: 15.89%

2022 (FYE 31Dec): RM180.120 mil (Eps: 0.0107), PAT: 11.13%

2021 (FYE 31Dec): RM67.575 mil (Eps: 0.0019), PAT: 5.30%

Order Book (LPD)

1. RM203.691 mil

Major customer (FPE2024)

1. Customer D: 50.01%

2. Customer E Group: 28.53%

3. Customer B: 14.19%

4. Takenaka (Malaysia) Sdn Bhd: 3.90%

5. Customer N: 0.51%

***total 97.14%

Major Sharesholders

1. CBH Equities: 72.76% (direct)

2. Ir. Cheah Boon Hwa : 72.76% (indirect)

3. Cheah Boon Huat: 72.76% (indirect)

4. Cheah Boon Kiat: 72.76% (indirect)

5. Cheah Boon Hoe: 72.76% (indirect)

6. Cheah Chai Siew: 72.76% (indirect)

Directors & Key Management Remuneration for FYE2024

(from Revenue & other income 2023)

Total director remuneration: RM2.679 mil

key management remuneration: RM3.40 mil – RM3.55mil

total (max): RM6.229 mil or 9.25%

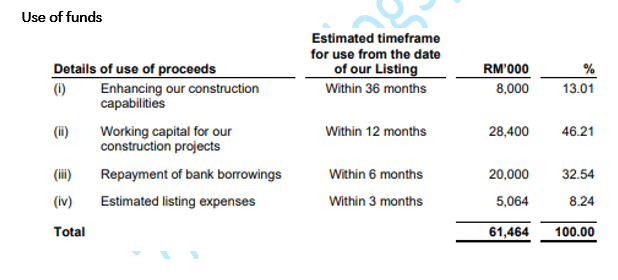

Use of funds

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is high risk investment, and also come with mid return opportunities.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.

.jpeg)

.jpeg)