Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Disclaimer***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision.

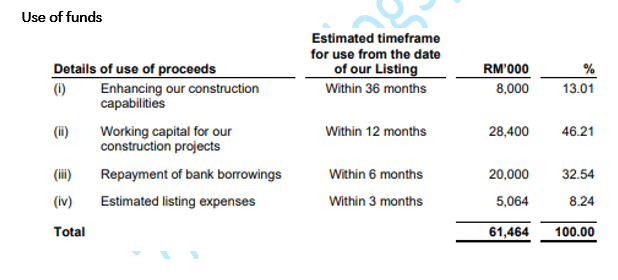

Close to apply: 15/11/2024

Balloting: 19/11/2024

Listing date: 29/11/2024

Share Capital

Market cap: RM107.5 mil

Total Shares: 430 mil shares

1st day listing tradable shares: 154.6 mil shares

Industry CARG

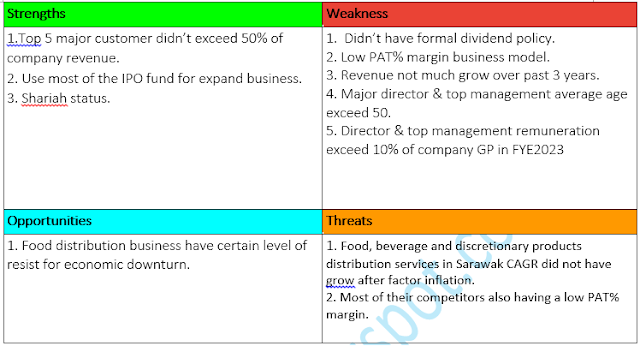

(i) 2018-2022

GDP of wholesale and retail trade, food and beverage and accommodation services in Sarawak: 1.9816%

Distribution of food, beverage and discretionary products in Sarawak: 1.9814%

(ii) 2019-2022

Average gross household income by district in Sarawak: 2.7%

Composition of monthly household expenditure in Sarawak: 4.4%

Industry competitors comparison (net profit%)

1. Supreme: 4.6%

2. Spritzer Berhad: 10.1% (not suitable for comparison purpose)

3. SDS Group Berhad: 10.0% (not suitable for comparison purpose)

4. Farm Fresh: 7.8% (not suitable for comparison purpose)

5. Others: -30.2% to 5.0%

Business (FYE 2024)

Distribution of third-party brands as well as our own brands of Frozen and Chilled Food Products, Ambient F&B Products and Non-F&B Products.

Revenue by Segment

Frozen and Chilled Food Products: 88.42%

Ambient F&B Products: 11.50%

Non-F&B Products: 0.08%

Revenue by Geo

Malaysia (Sarawak): 97.99%

Malaysia (Sabah): 0.41%

Mynmar: 1.6%

Fundamental

1.Market: Ace Market

2.Price: RM0.25

3.Forecast P/E: 11.90

4.ROE(Pro forma III): 10.3%

5.ROE: 11.76% (FPE2024), 10.49%(FYE2023), 9.93%(FYE2022), 9.86%(FYE2021)

6.Net asset: nil

7.Total debt to current asset: 0.478 (Debt: 47.347mil, Non-Current Asset: 52.889mil, Current asset: 99.096mil)

8.Dividend policy: Didn’t have formal dividend policy.

9. Shariah status: Shariah

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2024 (FPE 30Apr, 7mths): RM132.695 mil (Eps: 0.0146), PAT: 4.74%

2023 (FYE 30Sep): RM199.643 mil (Eps: 0.0214), PAT: 4.62%

2022 (FYE 30Sep): RM209.953 mil (Eps: 0.0190), PAT: 3.89%

2021 (FYE 30Sep): RM187.502 mil (Eps: 0.0178), PAT: 4.08%

***Our reviewer refuse to follow Prospectus book using EPS @ 120mil shares (pg 301).

***Above suggested EPS based on 430 mil shares.

Major customer (2024)

1. Unaco Group: 7.64%

2. Emart Group: 5.39%

3. Group A: 2.69%

4. MFM Resources Sdn Bhd: 2.6%

5. Supreme Food Supply (Bintulu) Sdn Bhd: 2.35%

***total 20.67%

Major Sharesholders

1. BNDM: 34.05% (direct)

2. Dato Richard Wee: 0.49% (direct), 34.24% (indirect)

3. Lim Ah Ted: 21.98% (direct)

4. Ting Ing Thai : 4.6% (direct)

5. Tan Chiew Ting: 6.28% (direct)

Directors & Key Management Remuneration for FYE2024

(from Revenue & other income FYE2023)

Total director remuneration: RM1.561 mil

key management remuneration: RM1.90 mil – RM2.25 mil

total (max): RM3.811 mil or 15.97%

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is middle risk investment with low grow rate business.