Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Disclaimer***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision.

Open to apply: 29 May 2025

Close to apply: 19 June 2025

Balloting: 23 June 2025

Listing date: 02 Jul 2025

Close to apply: 19 June 2025

Balloting: 23 June 2025

Listing date: 02 Jul 2025

Share Capital

Market cap: RM90.91 mil

Total Shares: 534.765 mil shares

1st day listing tradable shares: 181.821 mil

Industry CARG

1. F&B automation machinery solutions industry in Malaysia (2019-2024): 20.1%

2. Consumer spending on snacks in Malaysia (2019-2024): 4.39%

Industry competitors comparison (net profit%)

1. ASM Automation Group Berhad: 18.2%

2. Easy Pack Machinery Sdn Bhd: 15.3%

3. Highpack Machinery Sdn Bhd: 10.2%

4. Microtherm Sdn Bhd: 9.5%

5. Kimah Industrial Supplies (M) Sdn Bhd: 7.0%

6. Others: losses to 6.7%

Business (FPE 2025)

Involved in the provision of automation machinery solutions and complementary solutions. Customers are primarily F&B manufacturing companies.

Revenue by segment

1. Automation machinery solutions: 93.0% (primarily F&B manufacturing companies)

2. Complementary solutions: 7.0%

Revenue by Geo

1. Malaysia: 58.6%

2. Vietnam: 15.1%

3. Thailand: 12.0%

3. Phillipines: 6.6%

5. Others: 7.7%

Fundamental

1.Market: Ace Market

2.Price: RM0.17

3.Forecast P/E: 12.78

4.ROE(Pro forma III): 10.37%

5.ROE: 10.37%(FPE2025), 23.33%(FYE2024), 14.3%(FYE2023), 12.3%(FYE2022)

6.Net asset: 0.10

7.Total debt to current asset: 0.23 (Debt: 14.067mil, Non-Current Asset: 5.922mil, Current asset: 60.235mil)

8.Dividend policy: Didn’t have formal dividend policy.

9. Shariah status: Yes

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2025 (FPE 31Dec, 9mths): RM27.995 mil (Eps: 0.0048), PAT: 9.2%

2024 (FYE 31Mar): RM39.133 mil (Eps: 0.0133), PAT: 18.2%

2023 (FYE 31Mar): RM35.821 mil (Eps: 0.0073), PAT: 10.9%

2022 (FYE 31Mar): RM35.052 mil (Eps: 0.0063), PAT: 9.60%

Major customer (FPE2025)

1. Liwayway Group: 19.3%

2. European Snack Food Group: 11.2%

3. Shoon Fatt Biscuit & Confectionery Factory Sdn Bhd: 6.2%

4. HLRB Processing Sdn Bhd: 6.1%

5. FFM Group: 6.0%

***total 48.8%

Major Sharesholders

1. Chan kok Heng, Aged 59: 50.9% (direct)

2. Leong Weng Khin, Aged 56: 15.1% (direct)

Directors & Key Management Remuneration for FYE2025

(from Revenue & other income 2024)

Total director remuneration: RM0.795 mil

key management remuneration: RM0.40 mil – RM0.60 mil

total (max): RM1.365 mil or 10.65%

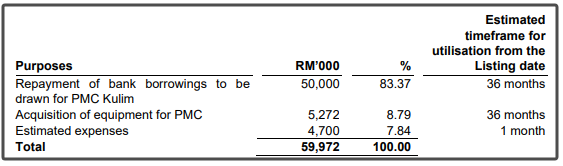

Use of funds

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is high risk investment, and also come with middle grow return opportunities.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.