Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Open to apply: 22/06/2021

Close to apply: 01/07/2021

Balloting: 05/07/2021

Listing date: 15/07/2021

Close to apply: 01/07/2021

Balloting: 05/07/2021

Listing date: 15/07/2021

Share Capital

Market Cap: RM177.384mil

Total Shares: 300mil shares

Market Cap: RM177.384mil

Total Shares: 300mil shares

Industry (Net Profit %)

Production Value of Livestock in Malaysia (CAGR): 6.6%

Growth Forecast for the Animal Health and Nutrition Industry (CAGR 2021-25): 4.3%

Production Value of Livestock in Malaysia (CAGR): 6.6%

Growth Forecast for the Animal Health and Nutrition Industry (CAGR 2021-25): 4.3%

Competitors compare (Profit before tax margin%)

Yenher: 14.6% (PE12.72)

Yenher: 14.6% (PE12.72)

Peterlabs: 6.8% (PE20.36)

AsiaVet: loss making

RhoneMa: 7.9% (PE17.16)

Danberg: 12%

Ritamix: 10.9% (PE23.49)

Sunzen: loss making

Business

Manufacturing and distribution of animal health and nutrition products.

Distribution: 44.26%

Manufacturing: 55.74%

Manufacturing and distribution of animal health and nutrition products.

Distribution: 44.26%

Manufacturing: 55.74%

Local market: 89.77%

Overseas market: 10.23%

Fundamental

1.Market: Main Market

2.Price: RM0.95 (EPS:RM0.0747)

3.P/E: PE12.72

4.ROE(Pro Forma III): 12.70%

5.ROE: 19.39%(2020), 18.73%(2019), 31.30%(2018), 22.09%(2017)

6.Cash & fixed deposit after IPO: 0.2144

7.NA after IPO: RM0.59

8.Total debt to current asset after IPO: 0.16 (Debt: 25.452mil, Non-Current Asset: 46.345mil, Current asset: 155.502mil)

9.Dividend policy: 40% PAT dividend policy.

1.Market: Main Market

2.Price: RM0.95 (EPS:RM0.0747)

3.P/E: PE12.72

4.ROE(Pro Forma III): 12.70%

5.ROE: 19.39%(2020), 18.73%(2019), 31.30%(2018), 22.09%(2017)

6.Cash & fixed deposit after IPO: 0.2144

7.NA after IPO: RM0.59

8.Total debt to current asset after IPO: 0.16 (Debt: 25.452mil, Non-Current Asset: 46.345mil, Current asset: 155.502mil)

9.Dividend policy: 40% PAT dividend policy.

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2020: RM202.635 mil (Eps: 0.0951),PAT%: 10.73%

2019: RM179.061 mil (Eps: 0.0838),PAT%: 15.07%

2018: RM181.109 mil (Eps: 0.1158),PAT%: 11.03%

2017: RM177.380 mil (Eps: 0.0808),PAT%: 11.05%

2020: RM202.635 mil (Eps: 0.0951),PAT%: 10.73%

2019: RM179.061 mil (Eps: 0.0838),PAT%: 15.07%

2018: RM181.109 mil (Eps: 0.1158),PAT%: 11.03%

2017: RM177.380 mil (Eps: 0.0808),PAT%: 11.05%

After IPO Sharesholding

CGH Holding: 45%

-Cheng Moon Tat: 7.5% direct, indirect 45%

-Cheng Mooh Kheng: 3.5% direct, indirect 45%

-Cheng Mooh Chye: 3.5% direct, indirect 45%

CGH Holding: 45%

-Cheng Moon Tat: 7.5% direct, indirect 45%

-Cheng Mooh Kheng: 3.5% direct, indirect 45%

-Cheng Mooh Chye: 3.5% direct, indirect 45%

Directors & Key Management Remuneration for FYE2021 (from gross profit 2020)

Total director remuneration: RM7.483

key management remuneration: RM0.70mil-0.95mil

total (max): RM8.433mil or 16.09%

Total director remuneration: RM7.483

key management remuneration: RM0.70mil-0.95mil

total (max): RM8.433mil or 16.09%

Use of fund

Construction of new GMP-Compliant Manufacturing Plant: 50.64%

Purchase of new machinery & equipment: 15.85%

Working capital: 27.30%

Listing expenses: 6.21%

Construction of new GMP-Compliant Manufacturing Plant: 50.64%

Purchase of new machinery & equipment: 15.85%

Working capital: 27.30%

Listing expenses: 6.21%

Highlight

1. Current manufacturing production utilisation rate at 100%.

2. New Manufacturing plant increase produce

-Complete feed & formulated product: 353.75% (573 to 2600 tones)

-Biotech animal feed ingredients: 422.65% (287 to 1,500 tones)

3. New Manufacturing plant to be completed build fourth quarter of 2023.

1. Current manufacturing production utilisation rate at 100%.

2. New Manufacturing plant increase produce

-Complete feed & formulated product: 353.75% (573 to 2600 tones)

-Biotech animal feed ingredients: 422.65% (287 to 1,500 tones)

3. New Manufacturing plant to be completed build fourth quarter of 2023.

4. Expand to more oversea market.

Good thing is:

1. PE12.72 below average competitor PE.

2. Debt is not high.

3. Have fixed dividend policy.

4. Revenue increase of 4 years.

5. Almost all IPO fund use to expand business.

6. by 2023 production increase 300%-400%

1. PE12.72 below average competitor PE.

2. Debt is not high.

3. Have fixed dividend policy.

4. Revenue increase of 4 years.

5. Almost all IPO fund use to expand business.

6. by 2023 production increase 300%-400%

The bad things:

1. Nett profit around 10%.

2. Industry growing CAGR is low 4.3%

3. Director & top management remuneration taking aways 16.09% gross revenue.

4. Three main director age above 52.

1. Nett profit around 10%.

2. Industry growing CAGR is low 4.3%

3. Director & top management remuneration taking aways 16.09% gross revenue.

4. Three main director age above 52.

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

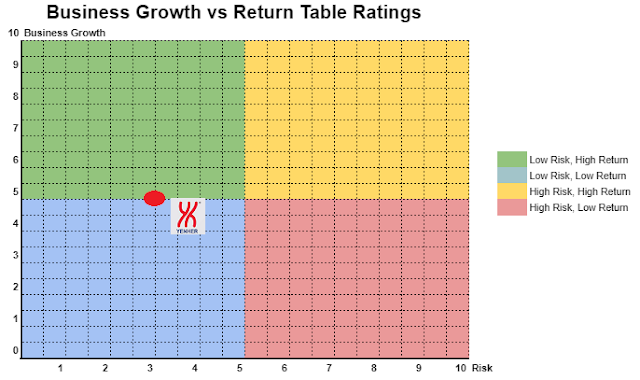

Is a little bit discounted IPO. With the new manafucturing facilites (to be completed by 2023), we should able to see better revenue grow in business. Business grwoth & risk refer to below chart.

Is a little bit discounted IPO. With the new manafucturing facilites (to be completed by 2023), we should able to see better revenue grow in business. Business grwoth & risk refer to below chart.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.