Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision

Open to apply: 28/02/2022

Close to apply: 08/03/2022

Balloting: 11/03/2022

Listing date: 22/03/2022

Close to apply: 08/03/2022

Balloting: 11/03/2022

Listing date: 22/03/2022

Share Capital

Market Cap: RM mil (will based on final instutional price for cal)

Total Shares: 1,857,954,837 shares

Market Cap: RM mil (will based on final instutional price for cal)

Total Shares: 1,857,954,837 shares

Industry Competitor

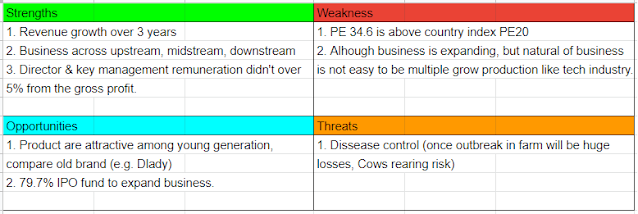

Farm fresh: PE34.6, PAT margin 6.7% (est without the tax penalty PAT 13.4%)

Nestle: PE55.76, PAT margin 10.21%

Dlady: PE8.39, PAT margin 6.67%

Farm fresh: PE34.6, PAT margin 6.7% (est without the tax penalty PAT 13.4%)

Nestle: PE55.76, PAT margin 10.21%

Dlady: PE8.39, PAT margin 6.67%

Business (2021)

Farming, manufacturing, and distribution of various dairy product and plant based product.

Malaysia: 84.6% (revenue)

Australia: 11.5%

Singapore: 3.8%

Brunei: 0.1%

Farming, manufacturing, and distribution of various dairy product and plant based product.

Malaysia: 84.6% (revenue)

Australia: 11.5%

Singapore: 3.8%

Brunei: 0.1%

Fundamental

1.Market: Main Market

2.Price: RM1.35 (if instutional price is lower, then retail price will refund the difference)

3.P/E: 34.6 (EPS:0.039, prospecture book assume without the tax penalty)

4.ROE(Pro Forma III): 8.7% (FPE2021)

5.ROE: 13.62%(FYE2021), 17.38%(FYE2020), 16.8%(FYE2019)

6.NA after IPO: RM0.31

7.Total debt to current asset after IPO: 0.7676 (Debt: 404.579mil, Non-Current Asset: 445.904mil, Current asset: 527.087mil)

8.Dividend policy: 24% PAT dividend policy.

1.Market: Main Market

2.Price: RM1.35 (if instutional price is lower, then retail price will refund the difference)

3.P/E: 34.6 (EPS:0.039, prospecture book assume without the tax penalty)

4.ROE(Pro Forma III): 8.7% (FPE2021)

5.ROE: 13.62%(FYE2021), 17.38%(FYE2020), 16.8%(FYE2019)

6.NA after IPO: RM0.31

7.Total debt to current asset after IPO: 0.7676 (Debt: 404.579mil, Non-Current Asset: 445.904mil, Current asset: 527.087mil)

8.Dividend policy: 24% PAT dividend policy.

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2021 (FPE Sep): RM257.187 mil (Eps: 0.031),PAT:19.2%

2021 (FYE 31Mar): RM490.498 mil (Eps: 0.022),PAT:6.7%

2020 (FYE 31Mar): RM303.067 mil (Eps: 0.021),PAT:11.3%

2019 (FYE 31Mar): RM178.227 mil (Eps: 0.026),PAT:15.4%

2021 (FPE Sep): RM257.187 mil (Eps: 0.031),PAT:19.2%

2021 (FYE 31Mar): RM490.498 mil (Eps: 0.022),PAT:6.7%

2020 (FYE 31Mar): RM303.067 mil (Eps: 0.021),PAT:11.3%

2019 (FYE 31Mar): RM178.227 mil (Eps: 0.026),PAT:15.4%

After IPO Sharesholding

1. Loi Tuan Ee: 44.52% (indirect)

2. Rainforest: 30.73%

3. Farmchoice: 13.79%

4. Agrifood: 11.8%

5. Khazanah: 11.8% (indirect)

6. Loi Foon Kion: 30.73% (indirect)

2. Rainforest: 30.73%

3. Farmchoice: 13.79%

4. Agrifood: 11.8%

5. Khazanah: 11.8% (indirect)

6. Loi Foon Kion: 30.73% (indirect)

Directors & Key Management Remuneration for FYE2022 (from gross profit 2021)

Total director remuneration: RM2.588mil

key management remuneration: RM3.5mil - 3.75mil

total (max): RM6.338mil or 4.50%

Total director remuneration: RM2.588mil

key management remuneration: RM3.5mil - 3.75mil

total (max): RM6.338mil or 4.50%

Use of fund

1.New manufacturing hub, dairy farm, & integrated processing facilities: 46.5%

2.Expansion production faiciliy in Australia: 19.9%

3.Regional expansin outside of Malaysia: 13.3%

4. Working capital: 13.6%

5. Listing expenses: 6.7%

1.New manufacturing hub, dairy farm, & integrated processing facilities: 46.5%

2.Expansion production faiciliy in Australia: 19.9%

3.Regional expansin outside of Malaysia: 13.3%

4. Working capital: 13.6%

5. Listing expenses: 6.7%

Highlight

1. Use 79.7% IPO fund to expand business (will increase production > increase revenue) 24mths to completed.

2. Expand Autralia production.

3. Expand to Southeast Asia region within 24 months.

4. UPM facilitiy commence operations in March 2022.

1. Use 79.7% IPO fund to expand business (will increase production > increase revenue) 24mths to completed.

2. Expand Autralia production.

3. Expand to Southeast Asia region within 24 months.

4. UPM facilitiy commence operations in March 2022.

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Is a good IPO but with a bit expensive offering price.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.