Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal

opinion and reader should take their own risk in investment decision.

opinion and reader should take their own risk in investment decision.

Open to apply: 29 August 2023

Close to apply: 12 September 2023

Balloting: 15 September 2023

Listing date: 26 September 2023

Share Capital

Market cap: RM267.5766 mil

Total Shares: 1.1149 bil shares

Market cap: RM267.5766 mil

Total Shares: 1.1149 bil shares

Industry CARG

Pawnbroking industry size in Malaysia CAGR (2017-2022): 5.2%

Industry competitors comparison (net profit%)

1. EMCC group: 30.56% (PE13.3)

2. PPjack: 14.46% (PE49)

3. Others (Sdn Bhd): -5.8% to 56.36%

Business (FYE 2023)

1. Pawnbroking services (Revenue: 30.3%)

- Monthly interest based on pawn loan.

- Administrative fee

2. Gold and luxury product retail and trading (Revenue: 69.2%)

- One-off sales.

3. Pawnbroking consultancy and IT solutions. (Revenue: 0.5%)

- Monthly consultation fee.

- Monthly IT solutions fee.

Fundamental

1.Market: Ace Market

2.Price: RM0.24

3.Forecast P/E: 13.3 (FYE2022, EPS RM0.018)

4.ROE(FPE2023): 11.12%

5.ROE: 5.1%(FPE2022), 11.06%(FYE2021), 8.3%(FYE2020),1.17%(FYE2019)

6.Net asset: RM0.17

7.Total debt to current asset: 0.394 (Debt: 69.246mil, Non-Current Asset: 26.428mil, Current asset: 175.866mil)

8.Dividend policy: 20% PAT dividend policy.

9. Shariah status: -

1.Market: Ace Market

2.Price: RM0.24

3.Forecast P/E: 13.3 (FYE2022, EPS RM0.018)

4.ROE(FPE2023): 11.12%

5.ROE: 5.1%(FPE2022), 11.06%(FYE2021), 8.3%(FYE2020),1.17%(FYE2019)

6.Net asset: RM0.17

7.Total debt to current asset: 0.394 (Debt: 69.246mil, Non-Current Asset: 26.428mil, Current asset: 175.866mil)

8.Dividend policy: 20% PAT dividend policy.

9. Shariah status: -

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2023 (FPE 30 Apr, 4mth): RM35.956 (Eps: 0.004), PAT: 13.7%

2022 (FYE 31Dec): RM67.173 mil (Eps: 0.0180), PAT: 29.8%

2021 (FYE 31Dec): RM60.903 mil (Eps: 0.0110),PAT: 19.6%

2020 (FYE 31Dec): RM24.426 mil (Eps: 0.0060),PAT: 25.9%

2019 (FYE 31Dec): RM14.802 mil (Eps: 0.0010),PAT: 5.4%

Major customer (2023)

1. Nexigold Jewellery Sdn Bhd: 22.6%

2. Gold Bullion Precious Metal Sdn Bhd: 33.3%

***total 55.9%

1. Nexigold Jewellery Sdn Bhd: 22.6%

2. Gold Bullion Precious Metal Sdn Bhd: 33.3%

***total 55.9%

Major Sharesholders

1. Tirai Anggerik: 55.6% (direct)

2. Dato’ Low Kok Chuan : 55.6% (Indirect)

3. Datin Tea Guat Ngo : 55.6% (Indirect)

4. Low Kok Hu: 55.6% (indirect)

5. Tee Kian Heng: 3.3% (indirect)

Directors & Key Management Remuneration for FYE2023

(from Revenue & other income 2022)

Total director remuneration: RM0.969 mil

key management remuneration: RM0.50 mil – RM0.65 mil

total (max): RM1.619 mil or 6.91%

Use of funds

1. Expansion of pawnshops: 31.1%

2. Cash capital for our pawnbroking business: 46.7%

3. Repayment of bank borrowings: 6.2%

4. Working capital: 8%

5. Estimated listing expenses: 7.2%

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

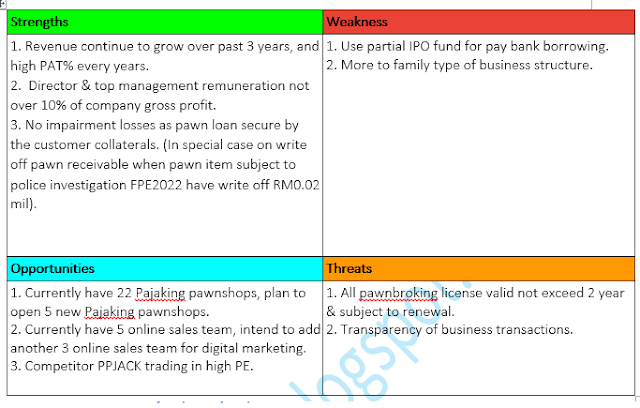

Overall is high risk investment, and also come with high grow return opportunities.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.