Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal

opinion and reader should take their own risk in investment decision.

opinion and reader should take their own risk in investment decision.

Open to apply: 05 Jan 2024

Close to apply: 11 Jan 2024

Balloting: 16 Jan 2024

Listing date: 26 Jan 2024

Share Capital

Market cap: nil (will need refer final institutional price)

Total Shares: 688 mil shares

Industry CARG (2018-22)

Value of Construction Work Completed for Electrical Installation in Malaysia: 14.2%

Value of Construction Work Completed for Plumbing, Heat and Air-conditioning Installation in Malaysia: 17.3%

Operating Revenue of Cleaning Activities in Singapore (2017-21): 0.2%

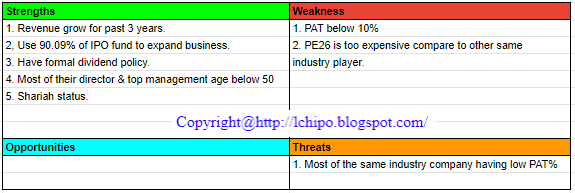

Industry competitors comparison (PAT%)

KJTS Group: 7.6% (PE26)

UEM Edgenta Bhd: 1.8% (PE16.79)

GFM Services Bhd: 13.0% (PE8.65)

Widad Group Bhd: -3.8% (Losses)

Gas District Cooling (M) S/B: 15.3%

Others: -12.3% to 6.4%

Business (FPE 2023)

Providing building support services comprising cooling energy, cleaning and FM services

Revenue by Segments

1. Cooling energy: 50.21%

2. Cleaning services: 39.12%

3. Facilities management: 10.67%

Fundamental

1.Market: Ace Market

2.Price: RM0.27 (will follow final institutional price)

3.Forecast P/E: 26.04 (forecast FPE2023, EPS RM0.01037)

4.ROE(Pro Forma III): 6.56%

5.ROE: 14.08%(FPE2023), 19.84%(FYE2022), 20.84%(FYE2021), 24.07%(FYE2020)

6.Net asset: 0.14

7.Total debt to current asset: 0.319 (Debt: 38.497mil, Non-Current Asset: 16.978mil, Current asset: 120.805mil)

8.Dividend policy: 20% PAT dividend policy.

9. Shariah status: Yes

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2023 (FPE 30 July, 7mths): RM71.767 (Eps: 0.0062),PAT: 5.29%

2022 (FYE 31 Dec): RM94.438 mil (Eps: 0.0100),PAT: 7.58%

2021 (FYE 31 Dec): RM85.285 mil (Eps: 0.0086),PAT: 7.01%

2020 (FYE 31 Dec): RM73.757 mil (Eps: 0.0078),PAT: 7.17%

Major customer (FPE 2023)

1. Bank Pembangunan Malaysia Berhad: 13.81%

2. Customer C: 10.36%

3. Micron Semiconductor (M) Sdn Bhd: 10.34%

4. Customer group A: 6.82%

5. Customer D: 4.69%

***total 46.02%

Major Sharesholders

1. Lee Kok Choon: 31.35%

2. Sheldon Wee Tah Poh: 31.35%

3. Yeow Boon Siang: 4.81%

Directors & Key Management Remuneration for FYE2023

(from Revenue & other income 2022)

Total director remuneration: RM1.874mil

key management remuneration: RM0.95mil – RM1.150mil

total (max): RM3.024 mil or 13.3%

Use of funds

1. Expansion of cooling energy segment: 68.66%

2. Expansion of offices in Malaysia, Thailand and Singapore: 7.64%

3. Working capital: 13.79%

4. Defraying the listing expenses: 9.91%

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is a low PAT% industry.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.