Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Disclaimer***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision.

Open to apply: 26/03/2025

Close to apply: 10/04/2025

Balloting: 17/04/2025

Listing date: 30/04/2025

Close to apply: 10/04/2025

Balloting: 17/04/2025

Listing date: 30/04/2025

Share Capital

Market cap: RM1.848

Total Shares: 1.4328 bil shares

1st day listing tradable shares: 365.364 mil shares

Industry CARG

1. Market Size of the Rental Industry for Home Appliances and Household Goods in Malaysia

(i)2019-2024e : 14.4%

(ii) 2024e-2028f: 9.9%

Industry competitors comparison (net profit%)

1. Cuckoo: 7.8% (Cuckoo Homesys Co Ltd, Korea: PE3.9x,Cuckoo elect: 5.0x)

2. Coway: 9.9% (Coway, Korea: PE11.1x)

3. SK Magic: -8.2%

4. Aeon : 2.8%

5. Parkson: 1.4%

6. Senheng: 1.9%

7. LG: 2.3%

1. Cuckoo: 7.8% (Cuckoo Homesys Co Ltd, Korea: PE3.9x,Cuckoo elect: 5.0x)

2. Coway: 9.9% (Coway, Korea: PE11.1x)

3. SK Magic: -8.2%

4. Aeon : 2.8%

5. Parkson: 1.4%

6. Senheng: 1.9%

7. LG: 2.3%

Business (FPE 2024)

Trading and rental of home appliances, mattresses and furniture, trading of beauty care products, provision of home care services, and investment holding activities.

Revenue by segment

1. Rental of product: 62.1%

2. Outright sale of product: 3.8%

3. Aftersales maintenance services: 33.7%

4. Others: 0.4%

Fundamental

1.Market: Main Market

2.Price: RM1.29 (will follow final institutional price)

3.Forecast P/E: 21.2x

4.ROE(Pro forma): 10.52%

5.ROE: 16.87% (FPE2024), 10.89%(FYE2023), 0.29%(FYE2022), 32.87%(FYE2021)

6.Net asset: 0.70

7.Total debt to current asset: 0.87(Debt: 637.891mil, Non-Current Asset: 904.464mil, Current asset: 730.651mil)

8.Dividend policy: 20% PAT dividend policy.

9. Shariah status: Yes

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2024 (FPE 30Sep): RM0.930 bil (Eps: 0.073), PAT: 11.1%

2023 (FYE 31Dec): RM1.116 bil (Eps: 0.061), PAT: 9.0%

2022 (FYE 31Dec): RM1.046 bil (Eps: 0.002), PAT: 14.4%

2021 (FYE 31Dec): RM1.139 bil (Eps: 0.130), PAT: 16.4%

Major Sharesholders

1. CUCKOO Homesys Co., Ltd : 52% (direct)

2. Koo Bon Hak, aged 56: 11% (direct), 52% (indirect)

3. Hoe Kian Choon, aged 50: 10% (direct)

4. CUCKOO Holdings: 52% (indirect)

Directors & Key Management Remuneration for FYE2025

(from Revenue & other income 2023)

Total director remuneration: RM1.719 mil

key management remuneration: RM0.3 mil – RM0.45 mil

total (max): RM2.169 mil or 0.59%

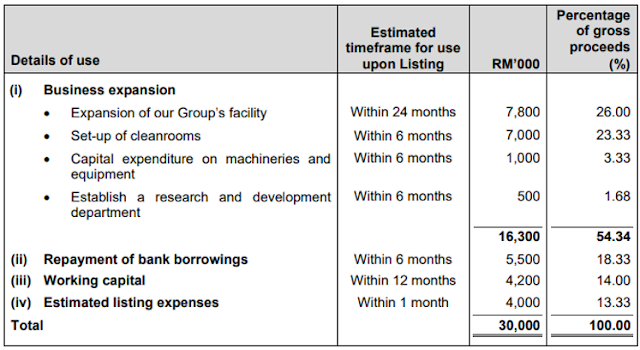

Use of funds

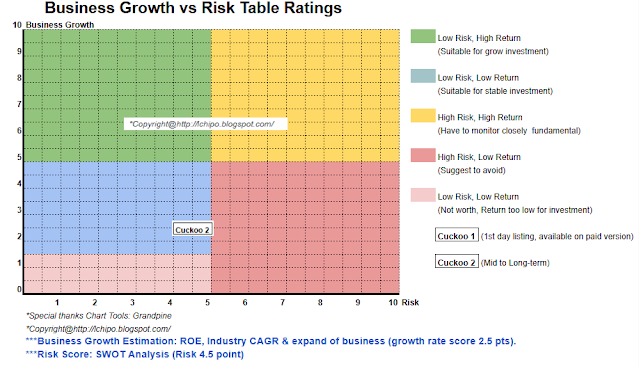

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is low risk investment, and also come with low grow return opportunities.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.