Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Disclaimer***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision.

Share Capital

Market cap: RM150 mil

Total Shares: 600 mil shares

1st day listing tradable shares: 178.5 mil shares

Industry CARG

Estimated Market Size (in terms of sales value of manufactured products in Malaysia) and Growth Forecast of the ESI in Malaysia (2021-2028f): 12.55%

Estimated Market Size (in terms of sales value of manufactured products in Malaysia) and Growth Forecast of the Surface Engineering Market in Malaysia, (2021-2028): 16.33%

Industry competitors comparison (net profit%)

1. Chemlite: 27.1%

2. Richport Technology Sdn Bhd: 44.7%

3. RTR Technology Sdn Bhd: 16.2%

4. Fukar Sdn Bhd: 12.6%

5. Metal Surface Progress Sdn Bhd: 7.5%

6. Amlex Holdings Berhad: 0.9%

7. Others: 4.9% to 7.7%

Business (FYE 2024)

Surface finishing treatment services in metal plating (through electroplating and/or electroless plating) and non-metal plating (primarily through anodising).

***Metal plating is a type of surface finishing treatment process that involves the deposition of 1 or more layers of metal coatings (such as gold, silver, palladium, nickel and/or other coating metals) onto the surface of an intermediate metal product. This process will alter the physical surface characteristics of the intermediate metal product, improving its functionality and characteristics, as well as enhancing its aesthetic appearance

Revenue by segment

1. Metal plating: 85.75%

2. Non-metal plating: 14.25%

Revenue by industries

1. E&E: 61.41%

2. Semiconductor: 28.22%

3. M&E: 9.76%

4. Others: 0.61% (include automotive and life science and medical technology industries)

Revenue by Geo

1. Malaysia: 75.03%

2. Philippines: 24.91%

3. Others: 0.06%

Fundamental

1.Market: Ace Market

2.Price: RM0.25

3.Forecast P/E: 16.23

4.ROE(Pro forma): 19.8%

5.ROE: 47.66%(FPE2024), 88.5%(FYE2023), 51.56%(FYE2022), 36.83%(FYE2021)

6.Net asset: 0.08

7.Total debt to current asset: 1.59 (Debt: 20.3mil, Non-Current Asset: 21.942mil, Current asset: 12.759mil)

8.Dividend policy: didn’t have format dividend policy.

9. Shariah status: Yes

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2024 (FPE 31Dec): RM34.192 mil (Eps: 0.0154), PAT: 27.08%

2023 (FYE 31Dec): RM28.048 mil (Eps: 0.0150), PAT: 32.09%

2022 (FYE 31Dec): RM22.147 mil (Eps: 0.0053), PAT: 14.35%

2021 (FYE 31Dec): RM18.396 mil (Eps: 0.0028), PAT: 8.98%

Major customer (FYE2024)

1. Customer A: 61.33%

2. Customer B: 24.97%

3. Customer C: 1.33%

4. Histotech Engineering Sdn Bhd: 1.11%

5. Alliance Contract Manufacturing Sdn Bhd: 1.01%

***total 89.75%

Major Sharesholders

1. Chong Yuen Fong: 38.5% (direct)

2. Heng Chee Khiang: 31.5% (direct), 0.25% (indirect).

Directors & Key Management Remuneration for FYE2025

(from Revenue & other income 2024)

Total director remuneration: RM1.372 mil

key management remuneration: RM0.4 mil – RM0.5 mil

total (max): RM1.872 mil or 12.98%

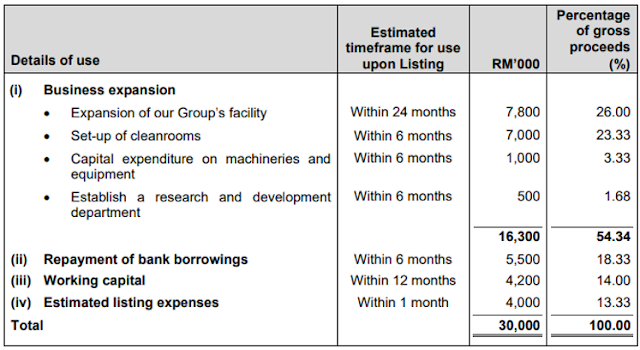

Use of funds

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is high risk investment, and also come with high grow return opportunities.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.