Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

***Important***Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision

Open to apply: 22/12/2021

Close to apply: 06/01/2022

Balloting: 10/01/2022

Listing date: 20/01/2022

Close to apply: 06/01/2022

Balloting: 10/01/2022

Listing date: 20/01/2022

Share Capital

Market Cap: RM119.932 mil

Total Shares: 428.331mil shares

Industry Competitor PAT

Coraza: 9.6% (PE19)

Alpha: -7.7%

Frencken: 6.1% (PE18, SGX Mrk)

Kobay: 17.2% (PE60)

Synturn: 17.4%

UWC: 26.4% (PE68)

Market Cap: RM119.932 mil

Total Shares: 428.331mil shares

Industry Competitor PAT

Coraza: 9.6% (PE19)

Alpha: -7.7%

Frencken: 6.1% (PE18, SGX Mrk)

Kobay: 17.2% (PE60)

Synturn: 17.4%

UWC: 26.4% (PE68)

Business (2021)

Sheet metal fabrication, Percision machining, & sub-modular assembly.

Semicoductor: 56.5%

Instrumentation: 17.9%

Life science & medical devices: 18.7%

Aerospace, telecommunication and E&E: 6.9%

Revenue by Geo (2021)

M'sia: 61.9%

S'pore: 28.3%

USA: 7.8%

Others: 0.4%

Euro: 1.6%

Fundamental

1.Market: Ace Market

2.Price: RM0.28

3.P/E: 19 (EPS:0.0147)

4.ROE(Pro Forma III): 16.97% (forecast using 6mth FPE2021)

5.ROE: 27.4%(FYE2020), 12.2%(FYE2019), 14%(FYE2018)

6.NA after IPO: RM0.15

7.Total debt to current asset after IPO: 0.969(Debt: 44.952 mil, Non-Current Asset: 62.337 mil, Current asset: 46.386 mil)

8.Dividend policy: no formal dividend policy.

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2021 (6mths): RM43.195 mil (Eps:0.0126),PAT: 12.5%

2020: RM83.686 mil (Eps:0.0147),PAT: 7.5%

2019: RM58.594 mil (Eps:0.0080),PAT: 5.8%

2018: RM56.023 mil (Eps:0.0081),PAT: 6.2%

After IPO Sharesholding

Paul Heng Weng Seng: 48.3%

Liew Sow Ying: 19.3%

Lim Teik Hoe: 19.3% (indirect)

Directors & Key Management Remuneration for FYE2022 (from gross profit 2020)

Total director remuneration: RM0.73 mil

key management remuneration: RM0.6mil - 0.85mil

total (max): RM1.58 mil or 7.4%

Use of fund

Purchase of new machinery: 47%

Construction of factory: 19.5%

Implementation of ERP system: 3.6%

Extension of existing buidling: 4.6%

Repayment of bank borrowings: 13.9%

Listing expenses: 11.4%

Highlight

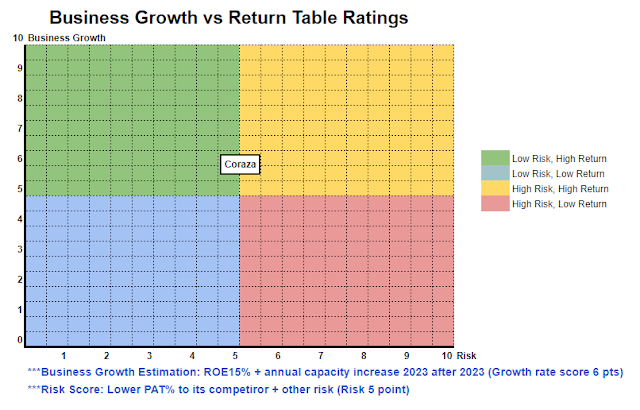

1. New factory will increase 25% capicity (estimated completed by Dec2023).

Good thing is:

1. Semiconductor industry on growing stage, PE19 is acceptable.

2. ROE still above 15%.

3. Revenue growing for past 3 years.

4. Director & key management remuneration is not high.

5. IPO for expand business capacity.

The bad things:

1. The company having concentration risk on 2 customer (66%-77% trade receivable from 2018-2021).

2. Director averaging above age 60.

3. Competitor in same industry have better performance.

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is still a discount IPO compare to their competitor that get high PE in same industry. After IPO should able to back to acceptable PE30 & above.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.