Copyright@http://lchipo.blogspot.com/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Follow us on facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Open to apply: 30/11/2021

Close to apply: 07/12/2021

Price determination date: 08/12/2021

Balloting: 09/12/2021

Listing date: 21/12/2021

Close to apply: 07/12/2021

Price determination date: 08/12/2021

Balloting: 09/12/2021

Listing date: 21/12/2021

Share Capital

Market Cap: RM916.5 mil

Total Shares: 889.8045mil shares

***Issue price RM1.03 (final price will finalise after institution offer completed)

Market Cap: RM916.5 mil

Total Shares: 889.8045mil shares

***Issue price RM1.03 (final price will finalise after institution offer completed)

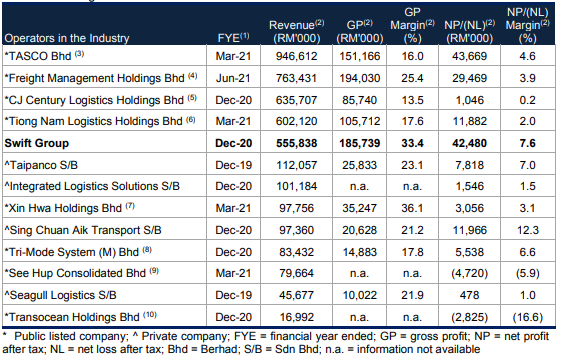

Industry Competitor PE

Tasco: PE14

Freight Management:PE13.8

CJCen: PE50.46

Tnlogis: PE24.92

Xinhwa: PE19.34

Tasco: PE14

Freight Management:PE13.8

CJCen: PE50.46

Tnlogis: PE24.92

Xinhwa: PE19.34

Business (2021)

Integrated logistics services: Container haulage, land transportion, freight forwarding, warehousing & container depot.

Other services: 3S for commercial vehicles, general insurance agency, E-commerce retailing.

Integrated logistics services: Container haulage, land transportion, freight forwarding, warehousing & container depot.

Other services: 3S for commercial vehicles, general insurance agency, E-commerce retailing.

Revenue by Geo (2021)

Msia: 93.8%

Thailand: 2.8%

other countries: 3.4%

Msia: 93.8%

Thailand: 2.8%

other countries: 3.4%

Fundamental

1.Market: Main Market

2.Price: RM1.03 (final price determined 08/12/2021)

3.P/E: 21.5 (EPS: 0.048)

4.ROE(Pro Forma III): 8.89% (forecast using 5mth FPE2021)

5.ROE: 9.8%(FYE2020), 9.45%(FYE2019), 12.17%(FYE2018)

6.Cash & fixed deposit after IPO: 0.0155

7.NA after IPO: RM0.35

8.Total debt to current asset after IPO: 3.1 (Debt: 0.751 bil, Non-Current Asset: 1.093 bil, Current asset: 0.235 bil)

9.Dividend policy: PAT 30% dividend policy.

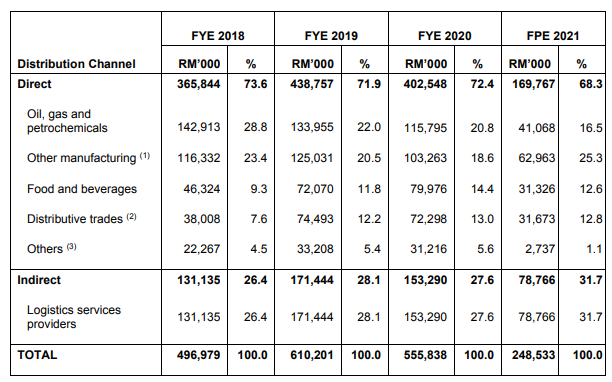

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2021 (5mths): RM248.533 mil (Eps: 0.025),PAT: 9.0%

2020: RM555.838 mil (Eps: 0.047),PAT: 7.6%

2019: RM610.201 mil (Eps: 0.041),PAT: 6.1%

2018: RM496.979 mil (Eps: 0.046),PAT: 8.3%

***EPS is base on comprehesiove income divided 899.8045 mil shares (Diluted EPS in prospectures book didn't use enlarged shares after IPO).

1.Market: Main Market

2.Price: RM1.03 (final price determined 08/12/2021)

3.P/E: 21.5 (EPS: 0.048)

4.ROE(Pro Forma III): 8.89% (forecast using 5mth FPE2021)

5.ROE: 9.8%(FYE2020), 9.45%(FYE2019), 12.17%(FYE2018)

6.Cash & fixed deposit after IPO: 0.0155

7.NA after IPO: RM0.35

8.Total debt to current asset after IPO: 3.1 (Debt: 0.751 bil, Non-Current Asset: 1.093 bil, Current asset: 0.235 bil)

9.Dividend policy: PAT 30% dividend policy.

Past Financial Performance (Revenue, Earning Per shares, PAT%)

2021 (5mths): RM248.533 mil (Eps: 0.025),PAT: 9.0%

2020: RM555.838 mil (Eps: 0.047),PAT: 7.6%

2019: RM610.201 mil (Eps: 0.041),PAT: 6.1%

2018: RM496.979 mil (Eps: 0.046),PAT: 8.3%

***EPS is base on comprehesiove income divided 899.8045 mil shares (Diluted EPS in prospectures book didn't use enlarged shares after IPO).

After IPO Sharesholding

Loo Yong Hui: 35.87% (indirect)

Dato' Haji Md Yusof: 35.87% (indirect)

Loo Hooi Keat: 35.87% (indirect)

Loo Yong Hui: 35.87% (indirect)

Dato' Haji Md Yusof: 35.87% (indirect)

Loo Hooi Keat: 35.87% (indirect)

Directors & Key Management Remuneration for FYE2022 (from gross profit 2020)

Total director remuneration: RM2.996 mil

key management remuneration: RM6 mil- 6.45 mil

total (max): RM9.446 mil or 5.09%

Total director remuneration: RM2.996 mil

key management remuneration: RM6 mil- 6.45 mil

total (max): RM9.446 mil or 5.09%

Use of fund

Constuction of new warehouse: 17.6% (currently have 6 warehouse)

Puchase of land: 25.7% (currently have 2.381 mil sq haulage yards)

Purchase of 30 prime movers: 7.4% (currently have 966 Prime mover, 5402 trailers)

Repayment bank borrowings: 43.1%

Listing expenses: 6.2%

Constuction of new warehouse: 17.6% (currently have 6 warehouse)

Puchase of land: 25.7% (currently have 2.381 mil sq haulage yards)

Purchase of 30 prime movers: 7.4% (currently have 966 Prime mover, 5402 trailers)

Repayment bank borrowings: 43.1%

Listing expenses: 6.2%

Highlight

1. New warehouse in Port Klang (estimated complete build 2nd quarter 2022).

2. Acquisition of cold-chain logistics companies (3rd quarter 2022).

1. New warehouse in Port Klang (estimated complete build 2nd quarter 2022).

2. Acquisition of cold-chain logistics companies (3rd quarter 2022).

Good thing is:

1. Director & key management remuneration below 10%.

1. Director & key management remuneration below 10%.

2. The company business is almost near to life necessity and economic necessity industry.

The bad things:

1. PE21.5 is above market average PE.

2. ROE below 15%

3. Debt to current asset ratio is too high.

4. Revenue did not growth much 2018-2021.

5. PAT% margin is less than 10%, & averege industry competiror PAT also not over 10% PAT (profit after tax margin)

6. 43.1% IPO use to repayment of bank borrowing.

7. Swift have 6 warehouse, expand 1 new warehouse highly chance will not double their revenue in 5 year.

The bad things:

1. PE21.5 is above market average PE.

2. ROE below 15%

3. Debt to current asset ratio is too high.

4. Revenue did not growth much 2018-2021.

5. PAT% margin is less than 10%, & averege industry competiror PAT also not over 10% PAT (profit after tax margin)

6. 43.1% IPO use to repayment of bank borrowing.

7. Swift have 6 warehouse, expand 1 new warehouse highly chance will not double their revenue in 5 year.

8. Purchase of 30 prime mover is small percentage of the total vehicle they have.

Conclusions (Blogger is not wrote any recommendation & suggestion. All is personal opinion and reader should take their own risk in investment decision)

Overall is an expensive IPO. The industry profit after tax margin for the company averagely is below 10 (Swift PAT: 7.6%). Company IPO PE is a bit higher then the industry average.

*Valuation is only personal opinion & view. Perception & forecast will change if any new quarter result release. Reader take their own risk & should do own homework to follow up every quarter result to adjust forecast of fundamental value of the company.Overall is an expensive IPO. The industry profit after tax margin for the company averagely is below 10 (Swift PAT: 7.6%). Company IPO PE is a bit higher then the industry average.